|

|

GLADSTONE INVESTMENT CORPORATION |

As filed with the Securities and Exchange Commission on July 21, 2009

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

1933 Act File No. 333-

Form N-2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| o PRE-EFFECTIVE AMENDMENT NO. o POST-EFFECTIVE AMENDMENT NO. |

GLADSTONE INVESTMENT CORPORATION

(Exact name of registrant as specified in charter)

1521 WESTBRANCH DRIVE, SUITE 200

MCLEAN, VA 22102

(Address of principal executive offices)

Registrant's telephone number, including area code: (703) 287-5800

DAVID GLADSTONE

CHAIRMAN AND CHIEF EXECUTIVE OFFICER

GLADSTONE INVESTMENT CORPORATION

1521 WESTBRANCH DRIVE, SUITE 200

MCLEAN, VIRGINIA 22102

(Name and address of agent for service)

COPIES TO:

THOMAS R. SALLEY, ESQ.

DARREN K. DESTEFANO, ESQ.

CHRISTINA L. NOVAK, ESQ.

COOLEY GODWARD KRONISH LLP

ONE FREEDOM SQUARE

RESTON TOWN CENTER

11951 FREEDOM DRIVE

RESTON, VIRGINIA 20190

(703) 456-8000

(703) 456-8100 (facsimile)

Approximate date of proposed public offering: From time to time after the effective date of this registration statement.

If any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933, as amended, other than securities offered in connection with a dividend reinvestment plan, check the following box. ý

CALCULATION OF REGISTRATION FEE UNDER THE SECURITIES ACT OF 1933

| Title of Securities Being Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(1) |

||

|---|---|---|---|---|

| Common Stock, $0.001 par value per share; Preferred Stock, $0.001 par value per share; Subscription Rights; Warrants; and Debt Securities | $300,000,000 | $16,740 | ||

| Total | $300,000,000 | $16,740 | ||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 21, 2009

PROSPECTUS

|

|

GLADSTONE INVESTMENT CORPORATION |

$300,000,000

COMMON STOCK

PREFERRED STOCK

SUBSCRIPTION RIGHTS

WARRANTS

DEBT SECURITIES

We may offer, from time to time, up to $300,000,000 aggregate initial offering price of our common stock, $0.001 par value per share, preferred stock, $0.001 par value per share, subscription rights, warrants representing rights to purchase shares of our common stock, or debt securities, or a combination of these securities, which we refer to in this prospectus collectively as our Securities, in one or more offerings. The Securities may be offered at prices and on terms to be disclosed in one or more supplements to this prospectus. In the case of our common stock and warrants or rights to acquire such common stock hereunder, the offering price per share of our common stock by us, less any underwriting commissions or discounts, will not be less than the net asset value per share of our common stock at the time of the offering except (i) in connection with a rights offering to our existing stockholders, (ii) with the consent of the majority of our common stockholders, or (iii) under such other circumstances as the Securities and Exchange Commission may permit. You should read this prospectus and the applicable prospectus supplement carefully before you invest in our Securities.

Our Securities may be offered directly to one or more purchasers, including existing stockholders in a rights offering, through agents designated from time to time by us, or to or through underwriters or dealers. The prospectus supplement relating to the offering will identify any agents or underwriters involved in the sale of our Securities, and will disclose any applicable purchase price, fee, commission or discount arrangement between us and our agents or underwriters or among our underwriters or the basis upon which such amount may be calculated. See "Plan of Distribution." We may not sell any of our Securities through agents, underwriters or dealers without delivery of a prospectus supplement describing the method and terms of the offering of such Securities. Our common stock is traded on The Nasdaq Global Select Market under the symbol "GAIN." As of July 20, 2009, the last reported sales price for our common stock was $4.84.

This prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference. This prospectus may not be used to consummate sales of securities unless accompanied by a prospectus supplement.

An investment in our Securities involves certain risks, including, among other things, risks relating to investments in securities of small, private and developing businesses. We describe some of these risks in the section entitled "Risk Factors," which begins on page 9. Shares of closed-end investment companies frequently trade at a discount to their net asset value and this may increase the risk of loss of purchasers of our Securities. You should carefully consider these risks together with all of the other information contained in this prospectus and any prospectus supplement before making a decision to purchase our Securities.

The Securities being offered have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

, 2009

| |

Page | |

|---|---|---|

Prospectus Summary |

1 | |

Additional Information |

8 | |

Risk Factors |

9 | |

Special Note Regarding Forward-Looking Statements |

26 | |

Use of Proceeds |

26 | |

Price Range of Common Stock and Distributions |

26 | |

Consolidated Selected Financial Data |

28 | |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

29 | |

Business |

65 | |

Portfolio Companies |

77 | |

Management |

86 | |

Control Persons and Principal Stockholders |

100 | |

Dividend Reinvestment Plan |

101 | |

Material U.S. Federal Income Tax Considerations |

102 | |

Regulation as a Business Development Company |

106 | |

Description of Our Securities |

108 | |

Certain Provisions of Delaware Law and of Our Certificate of Incorporation and Bylaws |

112 | |

Share Repurchases |

116 | |

Plan of Distribution |

116 | |

Custodian, Transfer and Dividend Paying Agent and Registrar |

117 | |

Brokerage Allocation and Other Practices |

118 | |

Legal Matters |

118 | |

Experts |

118 | |

Financial Statements |

F-1 |

We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any accompanying supplement to this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement as if we had authorized it. This prospectus and any prospectus supplement do not constitute an offer to sell or a solicitation of any offer to buy any security other than the registered securities to which they relate, nor do they constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such an offer or solicitation in such jurisdiction. The information contained in this prospectus and any prospectus supplement is accurate as of the dates on their respective covers only. Our business, financial condition, results of operations and prospects may have changed since such dates.

The following summary contains basic information about this offering. It likely does not contain all the information that is important to an investor. For a more complete understanding of this offering, we encourage you to read this entire document and the documents to which we have referred. Except where the context suggests otherwise, the terms "we," "us," "our," the "Company" and "Gladstone Investment" refer to Gladstone Investment Corporation; "Adviser" refers to Gladstone Management Corporation; "Administrator" refers to Gladstone Administration, LLC; "Gladstone Commercial" refers to Gladstone Commercial Corporation, "Gladstone Capital" refers to Gladstone Capital Corporation; and "Gladstone Companies" refers to our Adviser and its affiliated companies.

GLADSTONE INVESTMENT CORPORATION

General

We were incorporated under the General Corporation Laws of the State of Delaware on February 18, 2005. On June 22, 2005, we completed an initial public offering and commenced operations. We were primarily established for the purpose of investing in subordinated loans, mezzanine debt, preferred stock and warrants to purchase common stock of small and medium-sized companies in connection with buyouts and other recapitalizations. We also invest in senior secured loans, common stock and senior and subordinated syndicated loans. Our investment objective is to generate both current income and capital gains through these debt and equity instruments. We operate as a closed-end, non-diversified management investment company and have elected to be treated as a business development company, or BDC, under the Investment Company Act of 1940, as amended, which we refer to as the 1940 Act.

Our Investment Adviser and Administrator

Our Adviser is our affiliate and investment adviser and is led by a management team which has extensive experience in our lines of business. Excluding our chief financial officer, all of our executive officers serve as either directors or executive officers, or both, of Gladstone Commercial, a publicly traded real estate investment trust; Gladstone Capital, a publicly traded business development company; our Adviser; and our Administrator, a wholly-owned subsidiary of our Adviser. Our Administrator employs our chief financial officer, chief compliance officer, controller, treasurer and their respective staffs.

Our Adviser and our Administrator also provide investment advisory and administrative services, respectively, to our affiliates Gladstone Commercial, Gladstone Capital and Gladstone Land Corporation, an agricultural real estate company owned by our chairman and chief executive officer, David Gladstone. In the future, our Adviser may provide investment advisory and administrative services to other funds, both public and private, of which it is the sponsor.

We have been externally managed by our Adviser pursuant to an investment advisory and management agreement since our inception. Our Adviser was organized as a corporation under the laws of the State of Delaware on July 2, 2002, and is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Our Adviser is headquartered in McLean, Virginia, a suburb of Washington D.C., and also has offices in New York, New Jersey, Pennsylvania, Illinois, Texas and Georgia.

Our Investment Strategy

We seek to achieve returns from current income from senior, subordinated and mezzanine debt, and capital gains from preferred stock and warrants to purchase common stock that we acquire in connection with buyouts and recapitalizations of small and mid-sized companies with established

1

management teams. Our investments generally range between $10 million and $40 million each, although this investment size may vary proportionately as the size of our capital base changes. We invest either by ourselves or jointly with other buyout funds and/or management of the portfolio company, depending on the opportunity. If we are participating in an investment with one or more co-investors, then our investment is likely to be smaller than if we were investing alone.

We expect that our target portfolio over time will include mostly subordinated loans, mezzanine debt, preferred stock, and warrants to buy common stock. Structurally, subordinated loans and mezzanine loans usually rank lower in priority of payment to senior debt, such as senior bank debt, and may be unsecured. However, subordinated debt and mezzanine loans rank senior to common and preferred equity in a borrower's capital structure. Typically, subordinated debt and mezzanine loans have elements of both debt and equity instruments, offering returns in the form of interest payments associated with senior debt, while providing lenders an opportunity to participate in the capital appreciation of a borrower, if any, through an equity position. Due to its higher risk profile and often less restrictive covenants as compared to senior debt, mezzanine debt generally earns a higher return than senior secured debt. Any warrants associated with mezzanine loans are typically detachable, which allows lenders to receive repayment of their principal on an agreed amortization schedule while retaining their equity interest in the borrower. Mezzanine debt also may include a "put" feature, which permits the holder to sell its equity interest back to the borrower at a price determined through a pre-determined formula.

2

We may offer, from time to time, up to $300,000,000 of our Securities, on terms to be determined at the time of the offering. Our Securities may be offered at prices and on terms to be disclosed in one or more prospectus supplements. In the case of offering of our common stock and warrants or rights to acquire such common stock hereunder in any offering, the offering price per share, less any underwriting commissions or discounts, will not be less than the net asset value per share of our common stock at the time of the offering except (i) in connection with a rights offering to our existing stockholders, (ii) with the consent of the majority of our common stockholders, or (iii) under such other circumstances as the Securities and Exchange Commission may permit. If we were to sell shares of our common stock below our then current net asset value per share, such sales would result in an immediate dilution to the net asset value per share. This dilution would occur as a result of the sale of shares at a price below the then current net asset value per share of our common stock and a proportionately greater decrease in a stockholder's interest in our earnings and assets and voting interest in us than the increase in our assets resulting from such issuance.

Our Securities may be offered directly to one or more purchasers, including existing stockholders in a rights offering, by us or through agents designated from time to time by us, or to or through underwriters or dealers. The prospectus supplement relating to the offering will disclose the terms of the offering, including the name or names of any agents or underwriters involved in the sale of our Securities by us, the purchase price, and any fee, commission or discount arrangement between us and our agents or underwriters or among our underwriters or the basis upon which such amount may be calculated. See "Plan of Distribution." We may not sell any of our Securities through agents, underwriters or dealers without delivery of a prospectus supplement describing the method and terms of the offering of our Securities.

Set forth below is additional information regarding the offering of our Securities:

The Nasdaq Global Select Market Symbol |

GAIN | |

Use of Proceeds |

Unless otherwise specified in a prospectus supplement, we intend to use the net proceeds from the sale of our Securities first to pay down existing short-term debt, then to make investments in buyouts and recapitalizations of small and mid-sized companies in accordance with our investment objectives, with any remaining proceeds to be used for other general corporate purposes. See "Use of Proceeds." | |

Dividends and Distribution |

We have paid monthly dividends to the holders of our common stock and generally intend to continue to do so. The amount of the monthly dividends is determined by our Board of Directors on a quarterly basis and is based on our estimate of our annual investment company taxable income and net short-term taxable capital gains, if any. See "Price Range of Common Stock and Distributions." Certain additional amounts may be deemed as distributed to stockholders for income tax purposes. Other types of securities will likely pay distributions in accordance with their terms. |

3

Taxation |

We intend to continue to elect to be treated for federal income tax purposes as a regulated investment company, which we refer to as a RIC. So long as we continue to qualify, we generally will pay no corporate-level federal income taxes on any ordinary income or capital gains that we distribute to our stockholders. To maintain our RIC status, we must meet specified source-of-income and asset diversification requirements and distribute annually at least 90% of our taxable ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any, out of assets legally available for distribution. Due to the current economic environment, there is a risk that in future quarters we may be unable to satisfy one or more of these requirements. See "Material U.S. Federal Income Tax Considerations." | |

Trading at a Discount |

Shares of closed-end investment companies frequently trade at a discount to their net asset value. The possibility that our shares may trade at a discount to our net asset value is separate and distinct from the risk that our net asset value per share may decline. We cannot predict whether our shares will trade above, at or below net asset value. | |

Certain Anti-Takeover Provisions |

Our Board of Directors is divided into three classes of directors serving staggered three-year terms. This structure is intended to provide us with a greater likelihood of continuity of management, which may be necessary for us to realize the full value of our investments. A staggered board of directors also may serve to deter hostile takeovers or proxy contests, as may certain provisions of Delaware law and other measures we have adopted. See "Certain Provisions of Delaware Law and of Our Certificate of Incorporation and Bylaws." | |

Dividend Reinvestment Plan |

We have a dividend reinvestment plan for our stockholders. This is an "opt in" dividend reinvestment plan, meaning that stockholders may elect to have their cash dividends automatically reinvested in additional shares of our common stock. Stockholders who do not so elect will receive their dividends in cash. Stockholders who receive distributions in the form of stock will be subject to the same federal, state and local tax consequences as stockholders who elect to receive their distributions in cash. See "Dividend Reinvestment Plan." | |

Management Arrangements |

Gladstone Management Corporation serves as our investment adviser, and Gladstone Administration, LLC serves serve as our administrator. We have entered into a license agreement with our Adviser, pursuant to which our Adviser has agreed to grant us a non-exclusive license to use the name "Gladstone" and the Diamond G trademark. For a description of our Adviser, our Administrator, the Gladstone Companies and our contractual arrangements with these companies, see "Management—Certain Transactions—Investment Advisory and Management Agreement," "Management—Certain Transactions—Administration Agreement," "Management—Certain Transactions—Loan Servicing Agreement" and "Management—Certain Transactions—License Agreement." |

4

The following table is intended to assist you in understanding the costs and expenses that an investor in this offering will bear directly or indirectly. We caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus contains a reference to fees or expenses paid by "us" or "Gladstone Investment," or that "we" will pay fees or expenses, stockholders will indirectly bear such fees or expenses as investors in Gladstone Investment. The following percentages were calculated based on net assets as of March 31, 2009.

Stockholder Transaction Expenses:

|

|

|||

|---|---|---|---|---|

Sales load (as a percentage of offering price) |

— | % | ||

Dividend reinvestment plan expenses(1) |

None | |||

Estimated annual expenses (as a percentage of net assets attributable to common stock): |

||||

Management fees(2) |

3.03 | % | ||

Incentive fees payable under investment advisory and management agreement (20% of realized capital gains and 20% of pre-incentive fee net investment income)(3) |

— | % | ||

Interest payments on borrowed funds(4) |

2.50 | % | ||

Other expenses(5) |

1.14 | % | ||

Total annual expenses (estimated)(2)(5) |

6.67 | % | ||

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in our Securities. In calculating the following expense amounts, we have assumed that our annual operating expenses would remain at the levels set forth in the table above. In the event that securities to which this prospectus related are sold to or through underwriters, a corresponding prospectus supplement will restate this example to reflect the applicable sales load.

| |

1 Year | 3 Years | 5 Years | 10 Years | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

You would pay the following expenses on a $1,000 investment, assuming a 5% annual return |

$ | 66 | $ | 195 | $ | 320 | $ | 614 | |||||

While the example assumes, as required by the Securities and Exchange Commission, which we refer to as the SEC, a 5% annual return, our performance will vary and may result in a return greater or less than 5%. Additionally, we have assumed that the entire amount of such 5% annual return would constitute ordinary income as we have not historically realized positive capital gains (computed net of all realized capital losses) on our investments, nor do we expect to realize positive capital gains in the foreseeable future. Because the assumed 5% annual return is significantly below the hurdle rate of 7% (annualized) that we must achieve under the investment advisory and management agreement to trigger the payment of an income-based incentive fee, we have assumed, for purposes of the above example, that no income-based incentive fee would be payable if we realized a 5% annual return on our investments. Additionally, because we have not historically realized positive capital gains (computed net of all realized capital losses and unrealized capital depreciation) on our investments, we have assumed that we will not trigger the payment of any capital gains-based incentive fee in any of the indicated time periods. If we achieve sufficient returns on our investments, including through the realization of capital gains, to trigger an incentive fee of a material amount, our expenses, and returns to our investors after such expenses, would be higher than reflected in the example. In addition, while the example assumes reinvestment of all dividends and distributions at net asset value, participants in our dividend reinvestment plan will receive a number of shares of our common stock, determined by dividing the total dollar amount of the dividend payable to a participant by the market price per share

5

of our common stock at the close of trading on the valuation date for the dividend. See "Dividend Reinvestment Plan" for additional information regarding our dividend reinvestment plan.

This example and the expenses in the table above should not be considered a representation of our future expenses, and actual expenses (including the cost of debt, incentive fees, if any, and other expenses) may be greater or less than those shown.

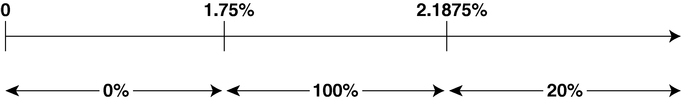

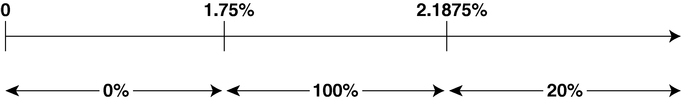

Examples of how the incentive fee would be calculated are as follows:

6

= 100% × (2.00% - 1.75%)

= 0.25%

= (100% × ("catch-up": 2.1875% - 1.75%)) + (20%× (2.30% - 2.1875%))

= (100% × 0.4375%) + (20% × 0.1125%)

= 0.4375% + 0.0225%

= 0.46%

= 20% × (6% - 1%)

= 20% × 5%

= 1%

Through March 31, 2009, our Adviser has not earned an incentive fee. For a more detailed discussion of the calculation of the two-part incentive fee, see "Management—Certain Transactions—Investment Advisory and Management Agreement."

7

We have filed with the SEC a registration statement on Form N-2 under the Securities Act of 1933, as amended, which we refer to as the Securities Act, with respect to the Securities offered by this prospectus. This prospectus, which is a part of the registration statement, does not contain all of the information set forth in the registration statement or exhibits and schedules thereto. For further information with respect to our business and our Securities, reference is made to the registration statement, including the amendments, exhibits and schedules thereto.

We also file reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. Such reports, proxy statements and other information, as well as the registration statement and the amendments, exhibits and schedules thereto, can be inspected at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Information about the operation of the public reference facilities may be obtained by calling the SEC at 1-202-551-8090. The SEC maintains a web site that contains reports, proxy statements and other information regarding registrants, including us, that file such information electronically with the SEC. The address of the SEC's web site is http://www.sec.gov. Copies of such material may also be obtained from the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. Our common stock is listed on The Nasdaq Global Select Market and our corporate website is located at http://www.gladstoneinvestment.com. The information contained on, or accessible through, our website is not a part of this prospectus.

We make available free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC.

We also furnish to our stockholders annual reports, which registered include annual financial information that has been examined and reported on, with an opinion expressed, by our independent registered public accounting firm. See "Experts."

8

You should carefully consider the risks described below and all other information provided and incorporated by reference in this prospectus (or any prospectus supplement) before making a decision to purchase our Securities. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or not presently deemed material by us, may also impair our operations and performance.

If any of the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected. If that happens, the trading price of our Securities could decline, and you may lose all or part of your investment.

Risks Related to the Economy

The current state of the economy and the capital markets increases the possibility of adverse effects on our financial position and results of operations. Continued economic adversity could impair our portfolio companies' financial positions and operating results and affect the industries in which we invest, which could, in turn, harm our operating results. Continued adversity in the capital markets could impact our ability to raise capital and reduce our volume of new investments.

The United States is in a recession. The recession generally, and the disruptions in the capital markets in particular, have decreased liquidity and increased our cost of debt and equity capital, where available. The longer these conditions persist, the greater the probability that these factors could continue to increase our costs of, and significantly limit our access to, debt and equity capital and, thus, have an adverse effect on our operations and financial results. Many of the companies in which we have made or will make investments are also susceptible to the recession, which may affect the ability of one or more of our portfolio companies to repay our loans or engage in a liquidity event, such as a sale, recapitalization or initial public offering. The recession could also disproportionately impact some of the industries in which we invest, causing us to be more vulnerable to losses in our portfolio, which could cause the number of our non-performing assets to increase and the fair market value of our portfolio to decrease. The recession may also decrease the value of collateral securing some of our loans as well as the value of our equity investments which would decrease our ability to borrow under our credit facility or raise equity capital, thereby further reducing our ability to make new investments.

The recession has affected the availability of credit generally and we have seen a reduction in committed funding under our credit facility from $125.0 million to $50.0 million and the withdrawal of Deutsche Bank, A.G. as a committed lender. Moreover, subsequent to our fiscal year end, we were forced to sell 29 of the 32 senior syndicated loans that were held in our portfolio of investments at March 31, 2009 in order to repay amounts outstanding under our prior credit facility. The loans, in aggregate, had a cost value of approximately $104.2 million, or 29.9% of the cost value of our total investments, and an aggregate fair market value of approximately $69.8 million, or 22.2% of the fair market value of our total investments, at March 31, 2009. As a result of these sales, we received approximately $69.2 million in net cash proceeds and recorded a realized loss of approximately $34.6 million. Our current credit facility limits our distributions to stockholders and as a result we recently decreased our monthly cash distribution rate by 50% as compared to the prior three month period in an effort to more closely align our distributions to our net investment income. We do not know when market conditions will stabilize, if adverse conditions will intensify or the full extent to which the disruptions will continue to affect us. Also, it is possible that persistent instability of the financial markets could have other unforeseen material effects on our business.

9

We may experience fluctuations in our quarterly and annual results based on the impact of inflation in the United States.

The majority of our portfolio companies are in industries that are directly impacted by inflation, such as manufacturing and consumer goods and services. Our portfolio companies may not be able to pass on to customers increases in their costs of production which could greatly affect their operating results, impacting their ability to repay our loans. In addition, any projected future decreases in our portfolio companies' operating results due to inflation could adversely impact the fair value of those investments. Any decreases in the fair value of our investments could result in future unrealized losses and therefore reduce our net assets resulting from operations.

Risks Related to Our External Management

We are dependent upon our key management personnel and the key management personnel of our Adviser, particularly David Gladstone, George Stelljes III, Terry Lee Brubaker and David Dullum, and on the continued operations of our Adviser, for our future success.

We have no employees. Our chief executive officer, president and chief investment officer, chief operating officer and chief financial officer, and the employees of our Adviser, do not spend all of their time managing our activities and our investment portfolio. We are particularly dependent upon David Gladstone, George Stelljes III, Terry Lee Brubaker and David Dullum in this regard. Our executive officers and the employees of our Adviser allocate some, and in some cases a material portion, of their time to businesses and activities that are not related to our business. We have no separate facilities and are completely reliant on our Adviser, which has significant discretion as to the implementation and execution of our business strategies and risk management practices. We are subject to the risk of discontinuation of our Adviser's operations or termination of the Advisory Agreement and the risk that, upon such event, no suitable replacement will be found. We believe that our success depends to a significant extent upon our Adviser and that discontinuation of its operations could have a material adverse effect on our ability to achieve our investment objectives.

Our incentive fee may induce our Adviser to make certain investments, including speculative investments.

The management compensation structure that has been implemented under the Advisory Agreement may cause our Adviser to invest in high risk investments or take other risks. In addition to its management fee, our Adviser is entitled under the Advisory Agreement to receive incentive compensation based in part upon our achievement of specified levels of income. In evaluating investments and other management strategies, the opportunity to earn incentive compensation based on net income may lead our Adviser to place undue emphasis on the maximization of net income at the expense of other criteria, such as preservation of capital, maintaining sufficient liquidity, or management of credit risk or market risk, in order to achieve higher incentive compensation. Investments with higher yield potential are generally riskier or more speculative. This could result in increased risk to the value of our investment portfolio.

We may be obligated to pay our Adviser incentive compensation even if we incur a loss.

The Advisory Agreement entitles our Adviser to incentive compensation for each fiscal quarter in an amount equal to a percentage of the excess of our investment income for that quarter (before deducting incentive compensation, net operating losses and certain other items) above a threshold return for that quarter. When calculating our incentive compensation, our pre-incentive fee net investment income excludes realized and unrealized capital losses that we may incur in the fiscal quarter, even if such capital losses result in a net loss on our statement of operations for that quarter. Thus, we may be required to pay our Adviser incentive compensation for a fiscal quarter even if there is a decline in the value of our portfolio or we incur a net loss for that quarter. For additional

10

information on incentive compensation under the Advisory Agreement with our Adviser, see "Business—Investment Advisory and Management Agreement."

Our Adviser's failure to identify and invest in securities that meet our investment criteria or perform its responsibilities under the Advisory Agreement may adversely affect our ability for future growth.

Our ability to achieve our investment objectives will depend on our ability to grow, which in turn will depend on our Adviser's ability to identify and invest in securities that meet our investment criteria. Accomplishing this result on a cost-effective basis will be largely a function of our Adviser's structuring of the investment process, its ability to provide competent and efficient services to us, and our access to financing on acceptable terms. The senior management team of our Adviser has substantial responsibilities under the Advisory Agreement. In order to grow, our Adviser will need to hire, train supervise and manage new employees successfully. Any failure to manage our future growth effectively could have a material adverse effect on our business, financial condition and results of operations.

There are significant potential conflicts of interest which could impact our investment returns.

Our executive officers and directors, other than our chief financial officer, and the officers and directors of our Adviser, serve or may serve as officers, directors or principals of entities that operate in the same or a related line of business as we do or of investment funds managed by our affiliates. Accordingly, they may have obligations to investors in those entities, the fulfillment of which might not be in the best interests of us or our stockholders. For example, Mr. Gladstone, our chairman and chief executive officer, is the chairman of the board and chief executive officer of our Adviser, Gladstone Capital and Gladstone Commercial. In addition, Mr. Brubaker, our co-vice chairman, chief operating officer and secretary is the vice chairman, chief operating officer and secretary of our Adviser, Gladstone Capital and Gladstone Commercial. Mr. Stelljes, our co-vice chairman and chief investment officer, is also the president and chief investment officer of our Adviser, Gladstone Capital and Gladstone Commercial. Mr. Dullum, our president and a director, is a senior managing director of our Adviser and a director of Gladstone Capital and Gladstone Commercial. Moreover, our Adviser may establish or sponsor other investment vehicles which from time to time may have potentially overlapping investment objectives with those of ours and accordingly may invest in, whether principally or secondarily, asset classes similar to those we targeted. While our Adviser generally has broad authority to make investments on behalf of the investment vehicles that it advises, our Adviser has adopted investment allocation procedures to address these potential conflicts and intends to direct investment opportunities to the Gladstone affiliate with the investment strategy that most closely fits the investment opportunity. Nevertheless, the management of our Adviser may face conflicts in the allocation of investment opportunities to other entities managed by our Adviser. As a result, it is possible that we may not be given the opportunity to participate in certain investments made by other members of the Gladstone Companies or investment funds managed by investment managers affiliated with our Adviser.

In certain circumstances, we may make investments in a portfolio company in which one of our affiliates has or will have an investment, subject to satisfaction of any regulatory restrictions and, where required, to the prior approval of our Board of Directors. Our Board of Directors has approved the following types of co-investment transactions:

11

portfolio companies would result in lease terms consistent with the terms that the portfolio companies would be likely to receive were they not portfolio companies of ours.

Certain of our officers, who are also officers of our Adviser, may from time to time serve as directors of certain of our portfolio companies. If an officer serves in such capacity with one of our portfolio companies, such officer will owe fiduciary duties to all stockholders of the portfolio company, which duties may from time to time conflict with the interests of our stockholders.

In the course of our investing activities, we will pay management and incentive fees to the Adviser and will reimburse the Administrator for certain expenses it incurs. As a result, investors in our common stock will invest on a "gross" basis and receive distributions on a "net" basis after expenses, resulting in, among other things, a lower rate of return than one might achieve through our investors themselves making direct investments. As a result of this arrangement, there may be times when the management team of our Adviser has interests that differ from those of our stockholders, giving rise to a conflict.

Our Adviser is not obligated to provide a waiver of the base management fee, which could negatively impact our earnings and our ability to maintain our current level of distributions to our stockholders.

The Advisory Agreement provides for a base management fee based on our gross assets. Since our 2008 fiscal year, our Board of Directors has accepted a voluntary waiver to reduce the annual 2.0% base management fee on senior syndicated loan participations to 0.5% to the extent that proceeds resulting from borrowings were used to purchase such syndicated loan participations. However, our Adviser is not required to issue this or other waivers of fees under the Advisory Agreement, and to the extent our investment portfolio grows in the future, we expect these fees will increase. If our Adviser does not issue this waiver in future quarters, it could negatively impact our earnings and may compromise our ability to maintain our current level of distributions to our stockholders, which could have a material adverse impact on our stock price.

Our business model is dependent upon developing and sustaining strong referral relationships with investment bankers, business brokers and other intermediaries.

We are dependent upon informal relationships with investment bankers, business brokers and traditional lending institutions to provide us with deal flow. If we fail to maintain our relationship with such funds or institutions, or if we fail to establish strong referral relationships with other funds, we will not be able to grow our portfolio of loans and fully execute our business plan.

Risks Related to Our External Financing

Committed funding under our credit facility has been reduced from $125 million to $50 million. Any inability to expand the credit facility could adversely impact our liquidity and ability to find new investments or maintain distributions to our stockholders.

On April 14, 2009 we, through our wholly-owned subsidiary Gladstone Business Investment, LLC, entered into a second amended and restated credit agreement providing for a $50.0 million revolving line of credit, which we refer to as the Credit Facility, arranged by Branch Banking and Trust Company, or BB&T, as administrative agent. Key Equipment Finance Company Inc. also joined the Credit Facility as a committed lender. In connection with our entry into the Credit Facility, we borrowed $43.8 million under the Credit Facility to repay in full all principal and interest owing under our prior credit agreement. Committed funding under the Credit Facility was reduced from $125.0 million under our prior credit facility and Deutsche Bank A.G., who was a committed lender under the prior facility,

12

elected not to participate in the new facility and withdrew its commitment. As of July 15, 2009 we had $18.7 million of availability to draw down borrowings under the Credit Facility. The Credit Facility may be expanded up to $125.0 million through the addition of other committed lenders to the facility. However, if additional lenders are unwilling to join the facility on its terms, we will be unable to expand the facility and thus will continue to have limited availability to finance new investments under our line of credit. The Credit Facility matures on April 14, 2010, and if the facility is not renewed or extended by this date, all principal and interest will be due and payable within one year of maturity. Between the maturity date and April 14, 2011, our lenders have the right to apply all interest income to amounts outstanding under the Credit Facility. There can be no guarantee that we will be able to renew, extend or replace the Credit Facility upon its maturity on terms that are favorable to us, if at all. Our ability to expand the Credit Facility, and to obtain replacement financing at the time of maturity, will be constrained by then-current economic conditions affecting the credit markets. In the event that we are not able to expand the Credit Facility, or to renew, extend or refinance the Credit Facility at the time of its maturity, this could have a material adverse effect on our liquidity and ability to fund new investments.

Our business plan is dependent upon external financing, which is constrained by the limitations of the 1940 Act.

Our business requires a substantial amount of cash to operate and grow. We may acquire such additional capital from the following sources:

13

sales would result in an immediate dilution to the net asset value per share. This dilution would occur as a result of the sale of shares at a price below the then current net asset value per share of our common stock and a proportionately greater decrease in a stockholder's interest in our earnings and assets and voting interest in us than the increase in our assets resulting from such issuance. This imposes constraints on our ability to raise capital when our common stock is trading at below net asset value, as it has for the last year.

A change in interest rates may adversely affect our profitability and our hedging strategy may expose us to additional risks.

We anticipate using a combination of equity and long-term and short-term borrowings to finance our investment activities. As a result, a portion of our income will depend upon the difference between the rate at which we borrow funds and the rate at which we loan these funds. Higher interest rates on our borrowings will decrease the overall return on our portfolio.

Ultimately, we expect approximately 80% of the loans in our portfolio to be at variable rates determined on the basis of a LIBOR rate and approximately 20% to be at fixed rates. As of July 15, 2009, our portfolio had approximately 23% of the total of the loan cost value at variable rates, approximately 46% of the total loan cost value at variable rates with floors and approximately 31% of the total loan portfolio cost basis at fixed rates.

To date, we hold only one interest rate cap agreement. While hedging activities may insulate us against adverse fluctuations in interest rates, they may also limit our ability to participate in the benefits of lower interest rates with respect to the hedged portfolio. Adverse developments resulting from changes in interest rates or any future hedging transactions could have a material adverse effect on our business, financial condition and results of operations. Our ability to receive payments pursuant to our interest rate cap agreement is linked to the ability of the counter-party to that agreement to make the required payments. To the extent that the counter-party to the agreement is unable to pay pursuant to the terms of the agreement, we may lose the hedging protection of the interest rate cap agreement.

Our credit facility imposes certain restrictions on us which, if not complied with, could accelerate our repayment obligations under the facility, thereby materially and adversely affecting our liquidity, financial condition, results of operations and ability to pay distributions.

We will have a continuing need for capital to finance our loans. In order to maintain RIC status, we will be required to distribute to our stockholders at least 90% of our ordinary income and short-term capital gains on an annual basis. Accordingly, such earnings will not be available to fund additional loans. Therefore, we are party to the Credit Facility, which provides us with a revolving credit line facility of $50.0 million, of which $18.7 million was available for borrowings as of July 15, 2009. The Credit Facility permits us to fund additional loans and investments as long as we are within the conditions set out in the credit agreement. Current market conditions have forced us to write down the value of a portion of our assets as required by the 1940 Act and fair value accounting rules. These are not realized losses, but constitute adjustment in asset values for purposes of financial reporting and for collateral value for the Credit Facility. As assets are marked down in value, the amount we can borrow on the Credit Facility decreases.

As a result of the Credit Facility, we are subject to certain limitations on the type of loan investments we make, including restrictions on geographic concentrations, sector concentrations, loan size, dividend payout, payment frequency and status, and average life. The credit agreement also requires us to comply with other financial and operational covenants, which require us to, among other things, maintain certain financial ratios, including asset and interest coverage and a minimum net worth. As of March 31, 2009, we were in compliance with these covenants, however, our continued

14

compliance with these covenants depends on many factors, some of which are beyond our control. In particular, depreciation in the valuation of our assets, which valuation is subject to changing market conditions that remain very volatile, affects our ability to comply with these covenants. During the year ended March 31, 2009, net unrealized depreciation on our investments was approximately $19.8 million, compared to $11.5 million in the year ended March 31, 2008. Given the continued deterioration in the capital markets, net unrealized depreciation in our portfolio may continue to increase in future periods and threaten our ability to comply with the covenants under the Credit Facility. Accordingly, there are no assurances that we will continue to comply with these covenants. Under the Credit Facility, we are also required to maintain our status as a BDC under the 1940 Act and as a RIC under the Internal Revenue Code of 1986, as amended, or the Code. Because of changes in our asset portfolio, due to significant sales of Non-Control/Non-Affiliate investments, there is a significant possibility that we may not meet the asset diversification threshold under the Code's rules applicable to a RIC as of our next quarterly testing date, September 30, 2009. Although this failure alone, in our current situation, will not cause us to lose our RIC status, it will impose constraints on our ability to make any new investments, including additional investments in our portfolio companies (such as advances under our outstanding lines of credit) without jeopardizing our RIC status. For more information on our current RIC status, see "Material U.S. Federal Income Tax Considerations—Regulated Investment Company Status." Our failure to satisfy these covenants could result in foreclosure by our lenders, which would accelerate our repayment obligations under the facility and thereby have a material adverse effect on our business, liquidity, financial condition, results of operations and ability to pay distributions to our stockholders.

Risks Related to Our Investments

We operate in a highly competitive market for investment opportunities.

A large number of entities compete with and make the types of investments that we seek to make in small and mid-sized companies. We compete with public and private buyout funds, commercial and investment banks, commercial financing companies, and, to the extent they provide an alternative form of financing, hedge funds. Many of our competitors are substantially larger and have considerably greater financial, technical, and marketing resources than we do. For example, some competitors may have a lower cost of funds and access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which would allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, many of our competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a business development company. The competitive pressures we face could have a material adverse effect on our business, financial condition, and results of operations. Also, as a result of this competition, we may not be able to take advantage of attractive investment opportunities from time to time, and we can offer no assurance that we will be able to identify and make investments that are consistent with our investment objective. We do not seek to compete primarily based on the interest rates we offer, and we believe that some of our competitors may make loans with interest rates that will be comparable to or lower than the rates we offer. We may lose investment opportunities if we do not match our competitors' pricing, terms, and structure. However, if we match our competitors' pricing, terms, and structure, we may experience decreased net interest income and increased risk of credit loss.

Our investments in small and medium-sized portfolio companies are extremely risky and you could lose all or a part of your investment.

Investments in small and medium-sized portfolio companies are subject to a number of significant risks including the following:

15

thus the current recession, and any further economic downturns or recessions are more likely to have a material adverse effect on them. If one of our portfolio companies is adversely impacted by a recession, its ability to repay our loan or engage in a liquidity event, such as a sale, recapitalization or initial public offering would be diminished. Moreover, in light of our current near-term strategy of preserving capital, our inability to make additional investments in our portfolio companies at a time when they need capital may increase their exposure to the risks of the current recession and future economic downturns.

16

resignation of one or more of these persons could have a material adverse impact on our borrower and, in turn, on us.

Because the loans we make and equity securities we receive when we make loans are not publicly traded, there will be uncertainty regarding the value of our privately held securities that could adversely affect our determination of our net asset value.

Our portfolio investments are, and we expect will continue to be, in the form of securities that are not publicly traded. The fair value of securities and other investments that are not publicly traded may not be readily determinable. Our Board of Directors has established an investment valuation policy and consistently applied valuation procedures used to determine the fair value of these securities quarterly. These procedures for the determination of value of many of our debt securities rely on the opinions of value submitted to us by Standard and Poor's Securities Evaluations, Inc., or SPSE, or the use of internally developed discounted cash flow, or DCF, methodologies, specifically for our syndicated loans, or internal methodologies based on the total enterprise value, or TEV, of the issuer used for certain of our equity investments. SPSE will only evaluate the debt portion of our investments for which we specifically request evaluation, and SPSE may decline to make requested evaluations for any reason in its sole discretion. However, to date, SPSE has accepted each of our requests for evaluation.

Our use of these fair value methods is inherently subjective and is based on estimates and assumptions of each security. In the event that we sell a security, the sale proceeds that we receive for that security may ultimately sell for an amount materially less than the estimated fair value calculated using SPSE, TEV or the DCF methodology. During April 2009, we completed the sale of 29 of the 32 senior syndicated loans that were held in our portfolio of investments at March 31, 2009 to various investors in the syndicated loan market. As a result of these sales, we received approximately $69.2 million in net cash proceeds, which was approximately $36.3 million less than the cost value of such investments recorded as of December 31, 2008.

Our procedures also include provisions whereby our Adviser will establish, subject to Board approval, the fair value of any equity securities we may hold where SPSE or third-party agent banks are unable to provide evaluations. The types of factors that may be considered in determining the fair value of our debt and equity securities include some or all of the following:

Because such valuations, particularly valuations of private securities and private companies, are not susceptible to precise determination, may fluctuate over short periods of time, and may be based on estimates, our determinations of fair value may differ from the values that might have actually resulted had a readily available market for these securities been available.

17

A portion of our assets are, and will continue to be, comprised of equity securities that are valued based on internal assessment using our own valuation methods approved by our Board of Directors, without the input of SPSE or any other third-party evaluator. We believe that our equity valuation methods reflect those regularly used as standards by other professionals in our industry who value equity securities. However, determination of fair value for securities that are not publicly traded, whether or not we use the recommendations of an independent third-party evaluator, necessarily involves the exercise of subjective judgment. Our net asset value could be adversely affected if our determinations regarding the fair value of our investments were materially higher than the values that we ultimately realize upon the disposal of such securities.

In April 2008, we adopted the provisions of Financial Accounting Standards Board, or FASB, Statement No. 157, Fair Value Measurements and we have followed the guidance of FASB Staff Position No. 157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active, which focused on fair market value accounting. The impact of these accounting standards on our consolidated financial statements for future periods cannot be determined at this time as it will be influenced by the estimates of fair value for those periods, the number and amount of investments we originate, acquire or exit and the effect of any additional guidance or any changes in the interpretation of this statement. If we are required to make further write-downs of our investment portfolio due to changes in market conditions, this could negatively impact the availability of funds under our line of credit and our ability to draw on the line of credit.

The lack of liquidity of our privately held investments may adversely affect our business.

We will generally make investments in private companies whose securities are not traded in any public market. Substantially all of the investments we presently hold and the investments we expect to acquire in the future are, and will be, subject to legal and other restrictions on resale and will otherwise be less liquid than publicly traded securities. The illiquidity of our investments may make it difficult for us to quickly obtain cash equal to the value at which we record our investments if the need arises. This could cause us to miss important investment opportunities. In addition, if we are required to liquidate all or a portion of our portfolio quickly, we may record substantial realized losses upon liquidation. In addition, we may face other restrictions on our ability to liquidate an investment in a portfolio company to the extent that we, our Adviser, or our respective officers, employees or affiliates have material non-public information regarding such portfolio company.

Due to the uncertainty inherent in valuing these securities, our determinations of fair value may differ materially from the values that could be obtained if a ready market for these securities existed. Our net asset value could be materially affected if our determinations regarding the fair value of our investments are materially different from the values that we ultimately realize upon our disposal of such securities.

Our financial results could be negatively affected if a significant portfolio investment fails to perform as expected.

Our total investment in companies may be significant individually or in the aggregate. As a result, if a significant investment in one or more companies fails to perform as expected, our financial results could be more negatively affected and the magnitude of the loss could be more significant than if we had made smaller investments in more companies. This risk is heightened as a result of our recent sale of the majority of senior syndicated loans that were held in our portfolio of investments at March 31, 2009. As a result of these sales, the total number of portfolio companies in which we hold investments decreased from 46 to 17.

18

When we are a debt or minority equity investor in a portfolio company, which we expect will generally be the case, we may not be in a position to control the entity, and its management may make decisions that could decrease the value of our investment.

We anticipate that most of our investments will continue to be either debt or minority equity investments in our portfolio companies. Therefore, we are and will remain subject to risk that a portfolio company may make business decisions with which we disagree, and the shareholders and management of such company may take risks or otherwise act in ways that do not serve our best interests. As a result, a portfolio company may make decisions that could decrease the value of our portfolio holdings. In addition, we will generally not be in a position to control any portfolio company by investing in its debt securities.

We typically invest in transactions involving acquisitions, buyouts and recapitalizations of companies, which will subject us to the risks associated with change in control transactions.

Our strategy includes making debt and equity investments in companies in connection with acquisitions, buyouts and recapitalizations, which subjects us to the risks associated with change in control transactions. Change in control transactions often present a number of uncertainties. Companies undergoing change in control transactions often face challenges retaining key employees and maintaining relationships with customers and suppliers. While we hope to avoid many of these difficulties by participating in transactions where the management team is retained and by conducting thorough due diligence in advance of our decision to invest, if our portfolio companies experience one or more of these problems, we may not realize the value that we expect in connection with our investments which would likely harm our operating results and financial condition.

Prepayments of our loans by our portfolio companies could adversely impact our results of operations and reduce our return on equity.

In addition to risks associated with delays in investing our capital, we are also subject to the risk that investments that we make in our portfolio companies may be repaid prior to maturity. We will first use any proceeds from prepayments to repay any borrowings outstanding on our credit facility. In the event that funds remain after repayment of our outstanding borrowings, then we will generally reinvest these proceeds in government securities, pending their future investment in new debt and/or equity securities. These government securities will typically have substantially lower yields than the debt securities being prepaid and we could experience significant delays in reinvesting these amounts. As a result, our results of operations could be materially adversely affected if one or more of our portfolio companies elects to prepay amounts owed to us. Additionally, prepayments could negatively impact our return on equity, which could result in a decline in the market price of our common stock.

Higher taxation of our portfolio companies may impact our quarterly and annual operating results.

The recession's adverse effect on federal, state, and municipality revenues may induce these government entities to raise various taxes to make up for lost revenues. Additional taxation may have an adverse affect on our portfolio companies' earnings and reduce their ability to repay our loans to them, thus affecting our quarterly and annual operating results.

Our portfolio is concentrated in a limited number of companies and industries, which subjects us to an increased risk of significant loss if any one of these companies does not repay us or if the industries experience downturns.

As of July 15, 2009, we had investments in 17 portfolio companies. Our investments in three of these portfolio companies, A. Stucki Holding Corp., Chase II Holdings Corp. and Acme Cryogenics, Inc., comprised approximately $87.2 million, or 36.5%, of our total investment portfolio, at cost. A consequence of a limited number of investments is that the aggregate returns we realize may be substantially adversely affected by the unfavorable performance of a small number of such loans or a

19

substantial write-down of any one investment. Beyond the limitations included in our credit facility and our regulatory and income tax diversification requirements, we do not have fixed guidelines for industry concentration and our investments could potentially be concentrated in relatively few industries. In addition, while we do not intend to invest 25% or more of our total assets in a particular industry or group of industries at the time of investment, it is possible that as the values of our portfolio companies change, one industry or a group of industries may comprise in excess of 25% of the value of our total assets. As of July 15, 2009, 23.5% of our total assets were invested in machinery companies and 23.5% of our total assets were also invested in diversified conglomerate manufacturing companies. As a result, a downturn in an industry in which we have invested a significant portion of our total assets could have a materially adverse effect on us.

Our investments are typically long term and will require several years to realize liquidation events.

Since we generally make five to seven year term loans and hold our loans and related warrants or other equity positions until the loans mature, you should not expect realization events, if any, to occur over the near term. In addition, we expect that any warrants or other equity positions that we receive when we make loans may require several years to appreciate in value and we cannot give any assurance that such appreciation will occur.

We may not realize gains from our equity investments.

When we invest in mezzanine or senior secured loans, we may acquire warrants or other equity securities as well. In addition we may invest in preferred and common stock. Our goal is ultimately to dispose of such equity interests and realize gains upon our disposition of such interests. However, the equity interests we receive may not appreciate in value and, in fact, may decline in value. Accordingly, we may not be able to realize gains from our equity interests, and any gains that we do realize on the disposition of any equity interests may not be sufficient to offset any other losses we experience.

Any unrealized depreciation we experience on our investment portfolio may be an indication of future realized losses, which could reduce our income available for distribution.

As a business development company we are required to carry our investments at market value or, if no market value is ascertainable, at fair value as determined in good faith by or under the direction of our Board of Directors. Decreases in the market values or fair values of our investments will be recorded as unrealized depreciation. Since our inception, we have, at times, incurred a cumulative net unrealized depreciation of our portfolio. Any unrealized depreciation in our investment portfolio could result in realized losses in the future and ultimately in reductions of our income available for distribution to stockholders in future periods.

Risks Related to Our Regulation and Structure

We currently do not meet the 50% threshold of the asset diversification test applicable to RICs under the Code. If we make any additional investment in the future, including advances under outstanding lines of credit to our portfolio companies, and remain below this threshold as of September 30, 2009, or any subsequent quarter end, we would lose our RIC status unless we are able to cure such failure within 30 days of the quarter end.

In order to maintain RIC status under the Code, in addition to other requirements, as of the close of each quarter of our taxable year, we must meet the asset diversification test, which requires that at least 50% of the value of our assets consist of cash, cash items, U.S. government securities, the securities of other RICs and other securities to the extent such other securities of any one issuer do not represent more than 5% of our total assets or more than 10% of the voting securities of such issuer. As a result of changes in the value of our assets during April and May 2009, due to significant sales of Non-Control/Non-Affiliate investments, we fell below the required 50% asset diversification threshold during the quarter ended June 30, 2009. Failure to meet this threshold alone does not result in loss of

20

our RIC status in our current situation. In circumstances where the failure to meet the 50% threshold as of a quarterly measurement date is the result of fluctuations in the value of assets, including in our case as a result of the sale of assets, we are still deemed under the rules to satisfy the asset diversification test and, therefore, maintain our RIC status, as long as we have not made any new investments, including additional investments in our portfolio companies (such as advances under outstanding lines of credit), since the time that we fell below the 50% threshold. At June 30, 2009, the first quarterly measurement date following the sales, we satisfied the 50% asset diversification threshold through the purchase of short-term qualified securities, which purchase was funded primarily through a short-term loan agreement. Subsequent to the June 30th measurement date, these securities matured and we repaid the short-term loan, at which time we again fell below the 50% threshold. See "—Recent Developments—Short-Term Loan" for more information regarding this transaction. As of the date of this prospectus, we remain below the 50% threshold. Thus, although we currently qualify as a RIC despite our current, and potential future, inability to meet the 50% asset diversification requirement, if we make any additional investments before regaining compliance with the asset diversification test, our RIC status will be threatened. Because, in most circumstances, we are contractually required to advance funds on outstanding lines of credit upon the request of our portfolio companies, we may have a limited ability to avoid adding to existing investments in a manner that would cause us to fail the asset diversification test as of September 30, 2009 or as of subsequent quarterly measurement dates.

If we were to make a new investment before regaining compliance with the 50% threshold, and we did not regain compliance prior to the next quarterly measurement date following the investment, we would have thirty days to "cure" our failure of the 50% threshold to avoid our loss of RIC status. Potential cures for failure of the asset diversification test include raising additional equity or debt capital, or changing the composition of our assets, which could include full or partial divestitures of investments, such that we would once again exceed the 50% threshold. We are currently seeking to obtain a short-term credit facility under which we would be able to borrow funds at each quarter end that would allow us to satisfy the asset diversification test for the foreseeable future, thereby allowing us to make additional investments prior to September 30, 2009 or thereafter and be in compliance with this test. There can be no assurance, however, that we will be able to enter into such a credit facility on reasonable terms, if at all, or that any other cures will be available to us such that our investment activity could resume. Our ability to implement any of these cures would be subject to market conditions and a number of risks and uncertainties that would be, in part, beyond our control. Accordingly, we can not guarantee you that we would be successful in curing any failure of the asset diversification test, which would subject us to corporate level tax. For additional information about the consequences of failing to satisfy the RIC qualification, see "—We will be subject to corporate level tax if we are unable to satisfy Internal Revenue Code requirements for RIC qualification."

We will be subject to corporate level tax if we are unable to satisfy Internal Revenue Code requirements for RIC qualification.

To maintain our qualification as a RIC, we must meet income source, asset diversification and annual distribution requirements. The annual distribution requirement is satisfied if we distribute at least 90% of our ordinary income and short-term capital gains to our stockholders on an annual basis. Because we use leverage, we are subject to certain asset coverage ratio requirements under the 1940 Act and could, under certain circumstances, be restricted from making distributions necessary to qualify as a RIC. Warrants we receive with respect to debt investments will create "original issue discount," which we must recognize as ordinary income, increasing the amounts we are required to distribute to maintain RIC status. Because such warrants will not produce distributable cash for us at the same time as we are required to make distributions in respect of the related original issue discount, we will need to use cash from other sources to satisfy such distribution requirements. The asset diversification requirements must be met at the end of each calendar quarter. If we fail to meet these tests, we may need to quickly dispose of certain investments to prevent the loss of RIC status. Since most of our

21

investments will be illiquid, such dispositions, if even possible, may not be made at prices advantageous to us and, in fact, may result in substantial losses. If we fail to qualify as a RIC for any reason and become fully subject to corporate income tax, the resulting corporate taxes could substantially reduce our net assets, the amount of income available for distribution, and the actual amount distributed. Such a failure would have a material adverse effect on us and our shares. For additional information regarding asset coverage ratio and RIC requirements, see "Material U.S. Federal Income Tax Considerations—Regulated Investment Company Status."

Changes in laws or regulations governing our operations, or changes in the interpretation thereof, and any failure by us to comply with laws or regulations governing our operations may adversely affect our business.

We and our portfolio companies are subject to regulation by laws at the local, state and federal levels. These laws and regulations, as well as their interpretation, may be changed from time to time. Accordingly, any change in these laws or regulations, or their interpretation, or any failure by us or our portfolio companies to comply with these laws or regulations may adversely affect our business. For additional information regarding the regulations to which we are subject, see "Material U.S. Federal Income Tax Considerations—Regulated Investment Company Status" and "Regulation as a Business Development Company."

Provisions of the Delaware General Corporation Law and of our certificate of incorporation and bylaws could restrict a change in control and have an adverse impact on the price of our common stock.

We are subject to provisions of the Delaware General Corporation Law that, in general, prohibit any business combination with a beneficial owner of 15% or more of our common stock for three years unless the holder's acquisition of our stock was either approved in advance by our Board of Directors or ratified by the Board of Directors and stockholders owning two-thirds of our outstanding stock not owned by the acquiring holder. Although we believe these provisions collectively provide for an opportunity to receive higher bids by requiring potential acquirers to negotiate with our Board of Directors, they would apply even if the offer may be considered beneficial by some stockholders.

We have also adopted other measures that may make it difficult for a third party to obtain control of us, including provisions of our certificate of incorporation classifying our Board of Directors in three classes serving staggered three-year terms, and provisions of our certificate of incorporation authorizing our Board of Directors to induce the issuance of additional shares of our stock. These provisions, as well as other provisions of our certificate of incorporation and bylaws, may delay, defer, or prevent a transaction or a change in control that might otherwise be in the best interests of our stockholders.

Risks Related to an Investment in Our Common Stock

We may experience fluctuations in our quarterly and annual operating results.